As people are living longer, a parallel older-age profile is emerging in the labour force.

Source: National Statistics 16/4/2019

Labour market statistics for the period December 2018 to February 2019 revealed some impressive results. In the UK, employment of those aged 16–64 was running at 76.1%, the joint highest level ever and up 0.7% on a year ago.

Drill down into National Statistics numbers and some interesting facts emerge:

- The increases are being driven by more women aged 50–64 in the workforce. At the start of the decade, 58.5% of women aged 50–64 were in employment, whereas the latest figure is 68.1%. Coincidentally in 2000, that was the male rate of employment in the 50–64 age band.

- The proportion of men aged 50–64 in work has also risen over the same period, but less dramatically – from 71.4% in 2010 to 76.8% now.

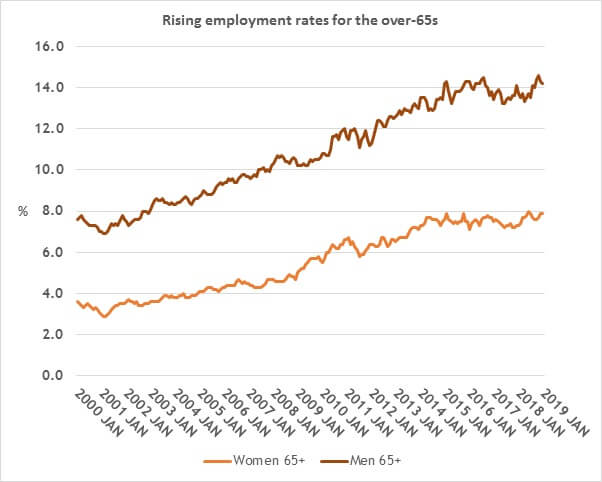

- At 65 and beyond, employment is reaching record levels for both men and women, as the graph shows. Women and men aged 65 and over have an employment rate of 7.9% and 14.2% respectively, compared to 5.5% (women) and 10.8% (men) in January 2010.

There are several reasons for the increase in employment beyond age 50:

- For women – and now men – the rise of state pension age (SPA) has undoubtedly had an impact. As recently as April 2010, the SPA for a woman was 60. By October next year, both men and women will share a SPA of 66.

- The ending of compulsory retirement ages has encouraged longer working lives.

- The gradual disappearance of final salary pension schemes, particularly in the private sector, has forced some people to revise their retirement plans.

- Economic conditions have played their part. Real (inflation-adjusted) wage growth has been virtually zero over the last 10 years, limiting the scope for retirement savings.

Working for longer can be beneficial to health, although the case is by no means clear cut: continuing work-related stress could be life shortening. The key is to be able to choose when to stop work, rather than have the decision forced upon you. To get into that position, there is no substitute for adequate retirement planning – preferably well before the age 50, yet alone 65, is reached.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Content correct at time of writing and is intended for general information only and should not be construed as advice