An obscure adjustment to old pension benefits, mandated by the courts, might cost some pension owners many thousands in additional tax.

The problems caused by the tapering of the annual allowance have been making the pension headlines for some time. Whereas the original focus was on NHS consultants and doctors, the issue is now rippling through other higher paid parts of the public sector, such as the senior levels of the armed forces and civil service. The government has started to suggest reforms, but these have concentrated on tweaking membership of the pension schemes involved rather than reforming the pension tax legislation.

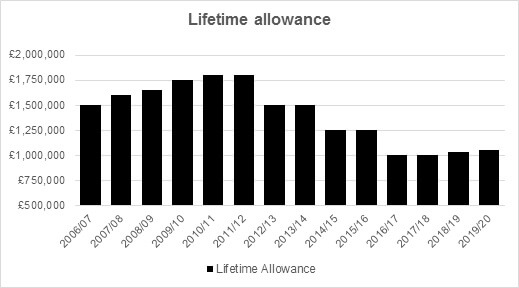

Another pension allowance conundrum is now looming, this time involving the lifetime allowance, which effectively sets the maximum tax-efficient value of all your pension benefits. The lifetime allowance has been reduced on three occasions, bringing it down from £1.8m in 2011/12 to £1.0m in 2016/17.

On each occasion the cut was accompanied by the launch of a ‘fixed protection’ option, allowing those affected to retain the existing allowance. So, for example, the 2012 version of fixed protection allowed the £1.8m lifetime allowance to be retained.

However, there was an important condition attached to all these fixed protections: they are lost if any additional contributions are made or any benefits are increased beyond the pension scheme’s normal indexation rules. At worst, an extra £1 of pension could see a fixed protected lifetime allowance of £1.8m reduced to the current standard lifetime allowance of £1.055m. In an extreme case, that could create an extra tax liability of over £400,000.

In theory the restriction means anyone with fixed protection should studiously avoid any risk of falling into that extra pension trap. In practice, some people – particularly the non-advised – forget or are unaware of the pitfall.

Now there is another potential danger, even for the diligent. An arcane 2018 High Court ruling on how to deal with equalisation of certain state-related pension benefits from the 1990s threatens to make automatic small increases to the benefits of some members of final salary pension schemes. Potentially enough to tip some over the threshold.

The situation now is that:

- The law, as interpreted by the High Court, says these ‘GMP equalisation’ adjustments must be made.

- Many pensions schemes have been, or are in the process of, calculating what those payments should be; but

- Everything has gone on hold for fear of the tax consequences. HMRC has not issued any guidance on the matter and is still ‘carefully considering’ what to do.

If nothing else, the problem is a reminder that if you have any form of pension protection, it can be highly valuable and advice should always be sought before any changes are made.

The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax or trust advice.

Content correct at time of writing and is intended for general information only and should not be construed as advice.