What do you remember about the 2010s?

A decade is a long time and a lot happens, but important details can be lost in the big headline moments. The one that has just ended makes the point. The 2010s started with Gordon Brown as prime minister and, four elections and two referendums later, closed with Boris Johnson in 10 Downing Street and the UK out of the EU. Over the entire period, the Bank of England’s base rate deviated no more than 0.25% either side of the 0.50% at which it began the decade.

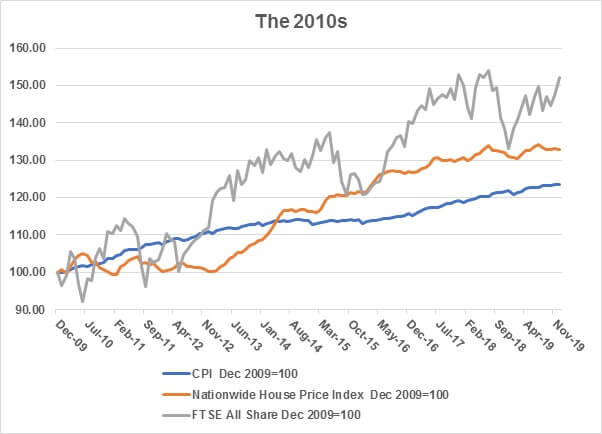

Inflation, as measured by the CPI, rose from 0.7% in January 2010 to peak at 5.1% in September 2011, but from 2012 onwards never breached 4%. It ended the decade at 1.3%. Across the decade, CPI inflation averaged 2.1%, just 0.1% above the Bank of England’s central target.

House prices, as measured by the Nationwide House Price Index (NHPI), beat inflation across the decade, but not significantly. As the graph shows, for most of the first five years house price rises underperformed, then took the lead as inflation subdued. Over the entire decade, the NHPI rose by 32.8%, equivalent to an annual increase of 2.9%. It may come as a surprise that the NHPI fell short of inflation, as measured by the Retail Price Index (RPI), which rose by 33.9% over the 2010s (3.0% annually).

The UK stock market, as measured by the FTSE All-Share Index, produced capital growth of over 50% in the 2010s, despite all the political traumas. That is equivalent to 4.3% annually, more than double the inflation rate. The progress was not smooth – the grey line on the graph does gyrate about somewhat – but neither was it an unnerving roller coaster.

Unfortunately we can’t project a similar graph for the 2020s. The new decade has started with falling inflation, interest rates set to stay at ultra-low levels, and both housing and share markets that appear to be experiencing a post-election bounce. In the absence of a decade-deep crystal ball, the wisest investment advice for the 2020s will be, as for every other decade, not to put all your eggs in one basket.

The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax advice. The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at time of writing and is intended for general information only and should not be construed as advice.