The first quarter of 2020 was a traumatic one for investors.

2020 started off well enough. Until the middle of February, most global share markets were flatlining as the year got under way. Then the coronavirus (Covid-19) outbreak suddenly expanded from a localised epidemic in Wuhan into a global issue. The reaction of most major stock markets was reminiscent of a certain Looney Tunes scene where Wile E Coyote races past the Road Runner only to find he has run off the edge of a cliff and his frantically spinning legs are taking him nowhere but straight down.

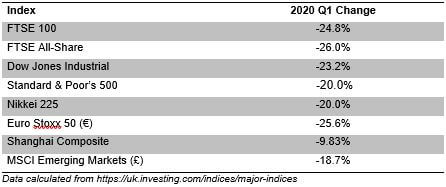

The quarterly performance of both the UK FTSE 100 and US Dow Jones Index was the worst since the final quarter of 1987 (when the UK experienced the Great Storm). No major markets escaped the impact of the virus, with most entering what the pundits label as bear market territory – a fall of 20% or more. Ironically, one of the best performing markets was China, where the Shanghai Composite fell less than 10%.

In response to the threat to global growth, central banks cut interest rates (where they could), returned to quantitative easing (QE) and promised variations on “whatever it takes”, the famous words of a former European Central Bank boss, Mario Draghi. Governments also took action, with many introducing employment support programmes (such as the UK’s Coronavirus Job Retention Scheme) and offering cheap finance and cash grants to businesses hit by the widespread lockdown.

It is wise to treat with scepticism any statements which claim to be able to predict what happens next. The form of the recovery – and there will be one at some indeterminate point – will determine how long the effects last. This uncertainty means that any changes to investment portfolios need to be approached with caution and only after taking expert advice.

The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at time of writing and is intended for general information only and should not be construed as advice.