November was an exciting month for the world’s stock markets.

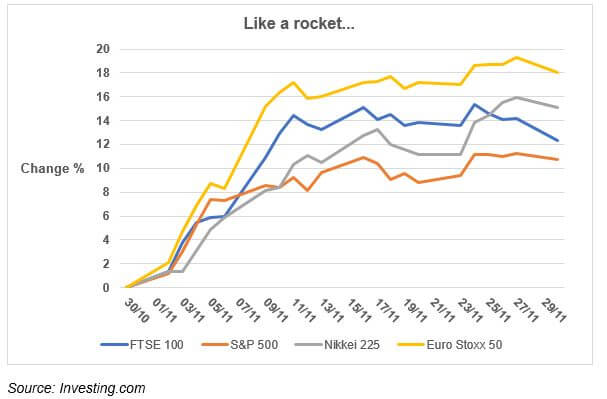

November was an exhilarating month on the world’s stock markets, as the graph above illustrates. It cannot be said that many experts – bar room or otherwise – expected it look like this.

Cast your mind back to Halloween and, apart from trick or treat, there was plenty to be concerned about. For a start the US presidential election was imminent. While it was widely forecast that Joe Biden would win, there was much less certainty that Donald Trump would recognise he had lost.

One layer down, serious worries were voiced about a gridlocked US government with a Democratic president unable to pass legislation through a Republican controlled Senate.

On a global scale, the primary concern was the second or, in some cases, third wave of the Covid-19 pandemic, prompting a new round of lockdowns with their inevitable impact on economic growth.

All that October gloom evaporated quickly in November. For example, the FTSE100 had its best month since January 1989, rising by 12.4%. It had even been on course to set a new record before a sharp fall on 30 November, possibly from profit-takers. Across on Wall Street, the Dow Jones Index had its best month since January 1987. At one point in November the Dow hit a new all-time record of over 30,000 – a “sacred number”, according to the outgoing president, who had pinned his re-election hopes on a strong economy.

So, what happened to make the world’s markets move from depression to euphoria? With hindsight two likely causes stand out:

- The US election was not the disaster that had been feared. Mr Trump has gradually, if indirectly, indicated that he will be moving out of 1600 Pennsylvania Avenue in January, despite ongoing lawsuits and social media outbursts. At the same time, markets seem to have concluded that, Georgia Senate run-offs notwithstanding, a gridlocked administration may not be such as bad idea if it means the status quo is maintained.

- The news of three successful vaccine trials suddenly allowed investors to see a way out of the pandemic in 2021.

November was once again a reminder of the potential danger of trying to time investing in markets: it was not a month to miss while sitting on the sidelines holding cash.

The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.