State pensions and the National Living Wage both increased in April.

April is the month when state benefits are uprated – unless they are subject to a freeze. It is also the month when the National Living Wage (NLW) and National Minimum Wage (NMW) are increased. In 2021, many social security benefits rose by 0.5%, as that was the annual rate of CPI inflation in September, the benchmark month.

The 0.5% increase applied to some state pensions, such as the additional state pension, but the main state pension, in both its old (pre 6 April 2016) and new (6 April 2016 onwards) guise rose by 2.5% – five times as much. This is because of the Triple Lock, which sets the minimum increase at 2.5%. As a result, the new state pension (currently payable from age 66, don’t forget) is now £179.60 a week.

April also saw the old state pension rise to £137.60 a week. The lower amount reflects that the former state pension system also incorporated an additional earnings-related pension for employees, supplied by the state and/or private provision (often a final salary pension scheme).

The maximum payment under the state additional pension element rose by 0.5%, to £181.31, which mostly benefits high-income earners. Those who qualify for the maximum state basic and additional pension under the pre-April 2016 regime are now receiving £318.91 a week. The design of the post-April 2016 state pension system was skewed towards low-income earners and, without the additional element, is less costly for the Treasury.

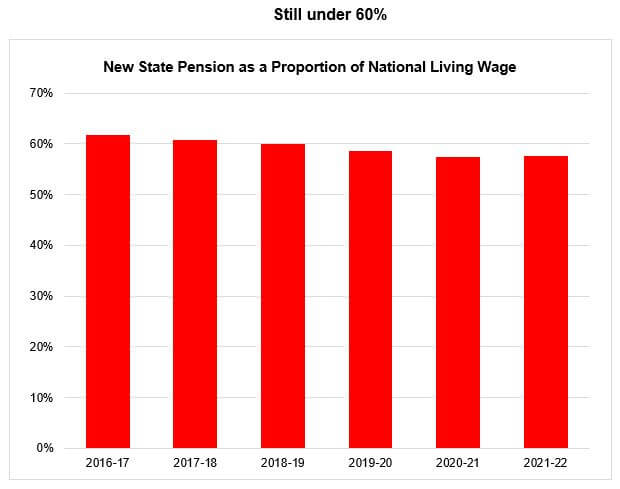

One other way to think about the new state pension is to compare it with how much you would earn from a 35-hour week at the minimum wage, which is £311.85. As the graph illustrates, that leaves the new state pension at less than 60% of the theoretical NMW weekly pay.

If you do not think you could live on the NMW, you should make sure your private pension provision is adequate.

The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.