One traditional way to answer the question of how much income you will need in retirement is to fix the amount as a percentage of pay. For example, when final salary pension schemes were more common, their target was often around two thirds of earnings. While this approach produces an easy to calculate number, it is arbitrary. For low earners it may produce too low a number, while at the opposite end of the scale the result may be too high.

An alternative is to focus on retirement living standards, an option that has been supported in the UK by the Pension and Lifetime Savings Association (PLSA) and is mirrored by approaches used in other countries. The PLSA sets three levels of post-pandemic retirement:

| MINIMUM | MODERATE | COMFORTABLE | |

| What standard of living could you have? | Covers all your needs, with some left over for fun. | More financial security and flexibility. | More financial freedom and some luxuries. |

| House | DIY maintenance and decorating one room a year. | Some help with maintenance and decorating each year. | Replace kitchen and bathroom every 10/15 years. |

| Food and drink | A £41 weekly food shop. | A £47 weekly food shop. | A £59 weekly food shop. |

| Transport | No car. | 3-year-old car replaced every 10 years. | 2-year-old car replaced every 5 years. |

| Holidays and leisure | One week in the UK and a long weekend in the UK every year. | 2 weeks in Europe and a long weekend in the UK every year. | 3 weeks in Europe every year. |

| Clothing and personal | £410 for clothing and footwear each year. | £730 for clothing and footwear each year. | £1,200 for clothing and footwear each year. |

| Helping others | £10 for each birthday present. | £30 for each birthday present. | £50 for each birthday present. |

Where would you want to be on those scales? It’s likely that most of us would veer towards ‘Comfortable’.

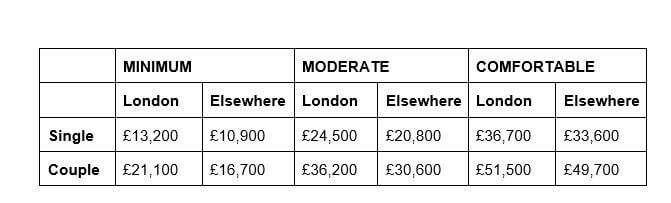

Now for the annual cost in terms of after-tax income:

If the numbers surprise you, then it is probably time to start checking that your retirement funding will meet the standard of living that you want.

The value of your investment and the income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax advice.