Changes to tax rules made some years ago could soon inflict financial pain as interest rates rise.

In the post-election Budget of 2015, the then Chancellor, George Osborne, announced a surprise set of changes to the tax rules for buy-to-let (BTL) residential properties. The most significant was the treatment of interest on BTL mortgages. At the time, interest paid could be offset fully against rental income, meaning that the interest received full tax relief at up to 45%. The Chancellor decided to replace this treatment with one in which:

- Interest could not be deducted from rent, thereby increasing the tax charged on rental income and, as a corollary, the property owner’s total taxable income; but

- A tax credit of 20% of interest paid would be given.

The reform was dramatic enough for Mr Osborne to phase it in over four years from April 2017, meaning that it did not take full effect until the 2020/21 tax year. By then, the Bank of England had reduced its base interest rate to 0.1% in response to the Covid-19 pandemic. Consequently, the reduction of tax relief on interest was less of an issue for BTL in 2020 than looked likely in 2015.

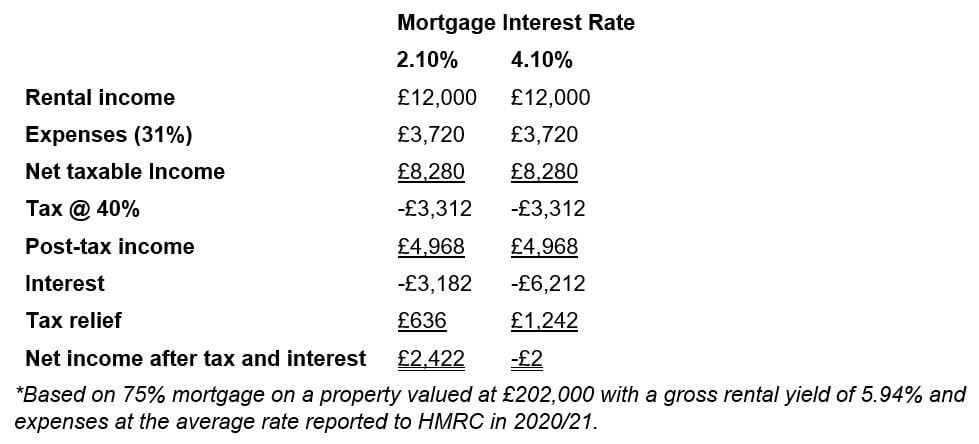

Just over two years later, the picture is altering rapidly as the Bank of England ratchets up interest rates to deal with post-pandemic inflation. One leading property agent has calculated that for some higher rate taxpaying BTL investors, an increase in mortgage rates of 2% could reduce their net income to nil:

The dramatic change to interest and tax relief highlights the risks inherent in borrowing to invest. The multiplier effect works of borrowing in both directions.

Tax treatment varies according to individual circumstances and is subject to change.

The Financial Conduct Authority does not regulate tax advice.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.