The September Consumer Prices Index (CPI) inflation reading is probably the most important inflation metric in a given year. Traditionally, this number is the one used by the Government as the basis for increasing tax allowances and bands, as well as benefits – including the state pension.

In recent years the significance of September’s CPI reading has waned, as the Government has chosen to freeze or restrict increases to limit the cost to the Exchequer of these benefits. The most obvious recent example is the freeze to the personal allowance (£12,570) and higher rate threshold (£50,270 outside Scotland), which would be £14,270 and £57,170 from April 2023 had the first two years of a four-year freeze not happened.

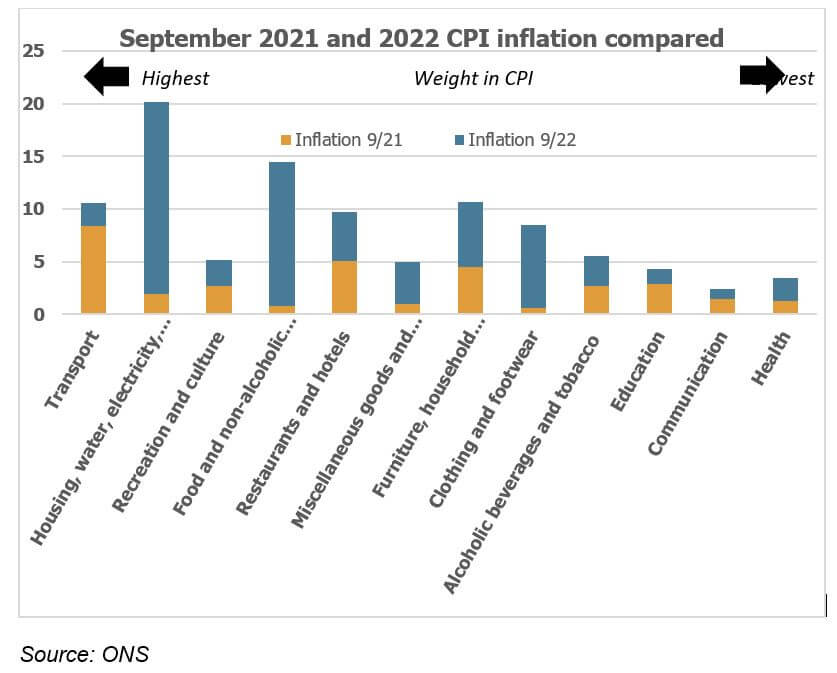

This year, the September 2022 annual inflation rate of 10.1% is more significant and not all it seems. The graph above shows the annual inflation rate in the 12 categories that make up the CPI ‘shopping basket’ of goods and services.

Only a third of those categories registered inflation above 10%. And another third recorded rises of no more than 5%. All the categories experienced higher inflation in September 2022 than September 2021, when the annual inflation rate was a more modest 3.0%, but the changes brought about over the intervening twelve months have had significantly varied effects across the different categories:

- Housing, water, electricity, gas and other fuels inflation has increased from 1.9% to 20.2%, due to the war in Ukraine, resulting in soaring energy bills.. This category is shortly expected to see another jump, as the Government’s new energy price guarantee took effect from 1 October.

- Food inflation jumped from 0.8% in 2021 to 14.5% in 2022. This can also be largely attributed to war in Ukraine. Not only has the war affected the production of grain and sunflower oil, directly increasing their prices, but the higher cost of fossil fuels – used in transportation and in fertiliser manufacture – has exacerbated the price increase.

- At the other end of the scale, however, the communications category, primarily telecoms, is experiencing only 2.4% inflation (albeit in 2021 the corresponding figure was 1.5%). Health (medical, hospital and outpatient services) has also seen a modest rise, from 1.3% to 3.5%.

These large variations help explain why your experience of inflation may seem, at different times, better or worse than the headline figure.

The Office for National Statistics (ONS) recognises this fact and has recently introduced an online personal inflation calculator which is worth exploring: https://www.ons.gov.uk/economy/inflationandpriceindices/articles/howisinflationaffectingyourhouseholdcosts/2022-03-23

It is important to build the impact of inflation into your financial plans, and wise to seek professional advice to better understand how these figures affect you personally.