Our Investment Management team conducts extensive analysis of economic and market information to construct investment portfolios for our clients. To offer insights into their work, we are sharing some of the fascinating charts they review in our client newsletters, providing explanations of what the charts reveal.

The release of ChatGPT by OpenAI has set off an investment frenzy amongst AI-linked stocks. The current chase for stocks related to artificial intelligence has been debated at length in the financial media and has grabbed many people’s attention. Retail investors in the US are jumping back into technology stocks for the first time this year, and there is a clear FOMO (Fear of missing out) chase in stocks closely associated with the development and implementation of AI.

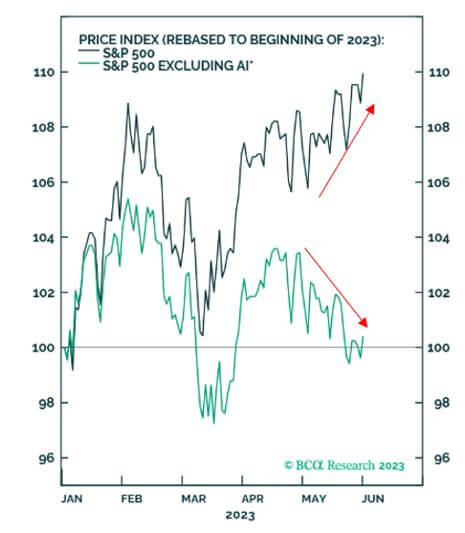

The above chart highlights the influence of AI-linked stocks on the performance of the US stock market in the year-to-date. The S&P 500 (black line), the index of the 500 largest companies listed on the US stock exchange, has increased by about 10% this year, in US dollar terms. However, if we exclude AI-linked stocks (green line), the US stock market is effectively flat for the year.

The deviation between AI-linked stocks and the rest of the US equity market was most pronounced in May. The median stock in the US was down by 4% in the month, yet the US stock market delivered positive returns, driven by large US technology and growth stocks such as Meta, Amazon, Alphabet, Tesla, Nvidia and Microsoft, companies which dominate the AI market.

We remain sceptical and cautious at this stage. AI has enormous potential over the long-term and the potential productivity gains could be meaningful for the global economy. However, at a company level, it is very expensive to build out AI capability and most of the AI technology available today is unreliable. Also, most notably, AI is a risk to jobs and human safety, so we fully expect significant regulation and government involvement in the sector, which could hinder growth and innovation.

The euphoria and excessive speculation around a handful of US stocks has pushed the US equity market to even more expensive valuation levels, and without any tangible increase to corporate revenues and profits, further supporting our underweight position. A very narrow market with a handful of stocks driving returns is typically not a good sign and doesn’t suggest a sustainable move higher in US equities is likely.

The contents of this article are for information purposes only and do not constitute individual advice.