At the start of 2023, the Prime Minister pledged to halve inflation. The goal was reached, but how much credit can he take for the achievement?

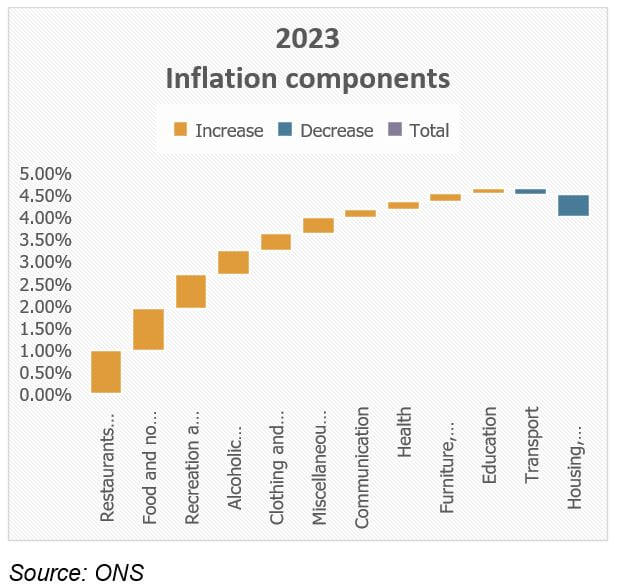

Inflation across 2023, as measured by the Consumer Prices Index (CPI) ended at 4.0%, a far cry from the 10.5% of 2022 and the October 2021 peak of 11.1%. The drop had been widely predicted, although in the final month of the year there was a small surprise: the rate rose 0.1% whereas the pundits had forecast a fall of the same amount.

The rapid decline in inflation – disinflation to use economists’ jargon – does not mean prices have generally fallen (deflation), although there were a few exceptions such as in electricity and gas prices. The absence of widespread price falls is one reason why the cost-of-living remains a live issue for politicians for the forthcoming general election.

The story behind the CPI’s fall in 2023 should give those same politicians something to consider before claims are made to conquer inflation:

- For example, the main driver of double-digit inflation in 2022 was energy prices. That meant higher fuel prices for all forms of transport – air fares rose by over 44% in 2022. It also pushed up domestic gas and electricity prices, by 128.9% and 65.4% respectively.

- In 2023, the opposite was true as energy prices declined: air fares rose by just 0.8% while gas prices tumbled by 31% and electricity by 15.4%. Those reversals were a major part of the overall decline in inflation. Energy prices are set globally beyond the influence of UK politicians.

It was a similar story with the rising prices of food. In 2022, food prices rose by 16.8% whereas a year later the annual increase was 8.0%. However, that was still double the overall inflation rate and left average food prices more than 26% up over the two years. On the fringes of food, there was an example where the government does have limited control over prices – alcoholic drinks. Here, the 2023 price rise was 9.6%, against 3.5% in 2022, in large part because of increases to alcohol duty.

The good news for 2024 is that inflation is expected to continue falling, with the consensus forecast for the final quarter of the year being just under 2.5%. However, it remains important to review the impact of past inflation on your financial planning: prices are up 21.8% since the end of 2019.

Content correct at time or writing.