The National Audit Office (NAO) has published a report on HMRC customer service which isn’t a happy story.

A common tactic for grabbing a headline, be it a politician or organisation, is to take a relatively modest number and then multiply it by the large population to whom it applies. The National Audit Office (NAO), the UK’s independent public spending watchdog, adopted this approach for a press release on its HMRC customer service report.

The ‘798 years on hold’ is the product of multiplying the average call waiting time in 2022/23 by the number of calls that were answered by an HMRC adviser (20.5 million out of the 38 million made – 53%). According to the NAO, waiting times rose in the first eleven months of 2023/24 to an average of nearly 23 minutes and the proportion of calls that reached an adviser dropped to just 45%. In 2018/19, the average wait was five minutes.

HMRC faces a variety of problems in its efforts to improve customer service:

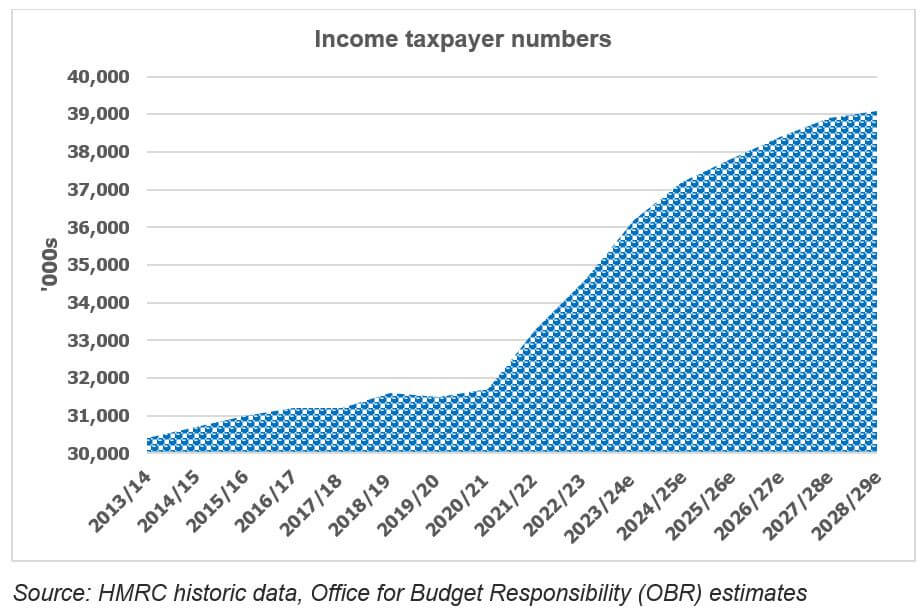

- As the graph illustrates, its customer base has been growing rapidly in recent years and will continue to do so. By 2028/29, the Office for Budget Responsibility (OBR) projects the income taxpayer population will be almost 25% larger than in 2019/20.

- Government tax strategy is increasing HMRC’s workload. The six-year freeze of the personal allowance and higher rate threshold (excluding Scotland) means more people are now taxpayers, and more people are entering the 40% tax rate band. Recent cuts to the dividend allowance and capital gains tax annual exemption add to the pressure. While the government attempted to ease HMRC’s burden by raising the threshold for automatic self assessment in 2023/24 from £100,000 to £150,000, this has been criticised as unwise because of the importance of the £100,000 threshold for the personal allowance and tax-free childcare.

- HMRC’s move to digital services has not eased pressure on traditional services as much as it had expected. The NAO noted that while digital transactions can be easier and faster for many customers, they do not allow more complex queries to be resolved at present.

HMRC does not expect to meet its telephone performance target in the current tax year, which is no real surprise. Unfortunately, while your financial adviser can often help you save tax and answer many of your tax queries, they have just as much difficulty in getting through to HMRC.

Tax treatment varies according to individual circumstances and is subject to change.

The Financial Conduct Authority does not regulate tax advice.

Content correct at the time of writing.