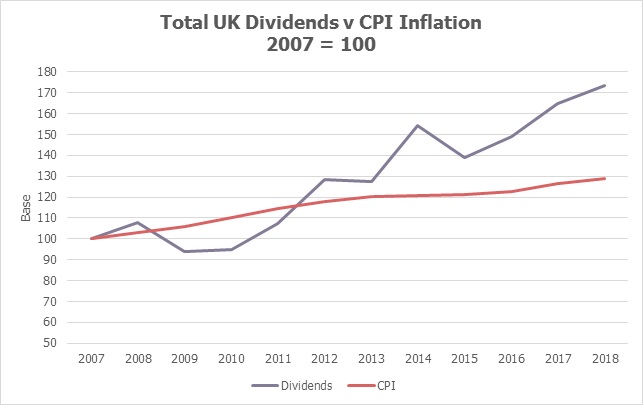

Dividend payments from UK companies in 2018 once again outpaced annual inflation.

Your income could have increased by more than double the rate of CPI inflation in 2018.

Link Asset Services, a leading share registrar, reported a 5.1% growth in total dividend payments of UK companies last year. Their January dividend monitor showed that in 2018 UK companies paid out £99.8bn in dividends, £4.8bn more than in 2017.

As the graph shows, since 2012, total dividend payments have comfortably outpaced inflation. The dividend line is not as smooth as the inflation line for two reasons:

- To a degree, what companies will pay in dividends depends upon financial conditions. The graph’s dip in 2009 and 2010 calendar years reflects the fallout from the great recession of 2007/08 when some major companies, e.g. clearing banks, suspended dividend payments completely.

- Total dividend payments represent the addition of regular dividends – what companies pay each year – and special dividends, which are one-off payments. From year to year, the ‘specials’ vary much more than regular dividends. A good example is 2014, when Vodafone sold out its US business interests and made a one-off dividend payment of nearly £16bn.

In its latest monitor, Link notes that rising dividends and falling share prices in 2018 meant that the yield on UK shares in December 2018 hit the highest level since March 2009. The 4.8% yield recorded by Link compares with an average over the last 30 years of 3.5%. In Link’s view, that level of dividend seems ‘’overly pessimistic” and is more likely to represent an undervaluation of UK stocks due to Brexit uncertainty as well as difficulties in the global market. It is hard to disagree.

The value of your investment can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at time of writing and is intended for general information only and should not be construed as advice