Q1 2023 Update

As we enter 2023, the most important macro-economic variables to consider are inflation and interest rates. If inflation falls meaningfully, central banks will stop raising interest rates which will ease financial conditions and any recession can be mild and brief. Fortunately, there are very convincing signs that inflationary pressures are diminishing and will continue to do so in 2023. Importantly, the major global Central Banks have indicated they are close to the end of their rate hiking cycle and have given a firm nod to falling inflation indicators, as well as weakening economic growth, suggesting a peak in interest rates is likely very soon.

Our macro views haven’t changed since the last review but some of our expectations are now playing out, particularly on the global inflation trends, Chinese policy with regards to Zero-Covid, economic stimulus and property market reforms, and we are therefore increasingly more confident for the year ahead.

Our core expected scenario sees Developed Market (DM) economies in aggregate falling into a mild recession in early 2023 which recent survey data suggests, however we believe most of this is broadly priced into markets. An improving inflation and interest rate environment, combined with China reopening, and diminishing energy crisis has brightened the outlook for the global economy and will support growth in the second half of the year.

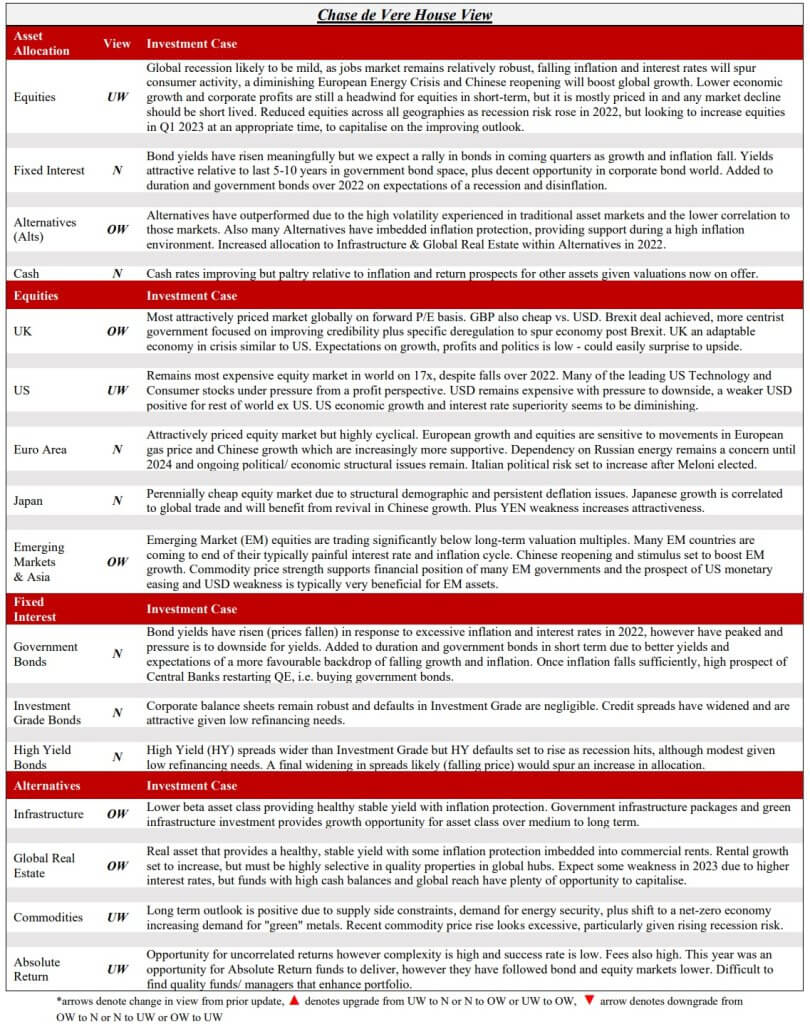

At this juncture, we maintain a neutral (N) view on Fixed Interest, moving from an underweight position. An overweight (OW) view to Alternatives is maintained and we remain underweight (UW) Equities, but are cognisant of the improving backdrop that will materialise as we move through the year, combined with attractive market valuations and fully intend to add back to equity risk at a suitable time in early 2023. The portfolios still have ample risk and have performed well in up markets relative to peers and benchmarks in recent months.

Last year was a year of continuous negative macro events including the Russia-Ukraine War, Energy Crisis, inflation surging, interest rates surging, China lockdowns and messy UK politics, and is unlikely to be repeated. We strongly believe there is gradual reversal in many of these macro events/ factors underway which will support markets over the course of 2023, as detailed below.

Economic Outlook 2023

We believe the global growth outlook will improve as we progress through the first half of 2023, and any recession will be mild and brief, due to:

- Inflation falling (disinflation). Historically major outbreaks of inflation subside relatively quickly 1-2 years after peak. All major outbreaks are driven by significant one-off global events such as war, oil crisis or commodity crisis. This time we had two major events in quick succession firstly a pandemic and then an energy crisis caused by a war leading to a sharp rise in inflation across the world, particularly the West. However, the pandemic is in the rear-view mirror and the energy crisis is improving dramatically. The subcomponents of inflation such as energy, goods, transport, supply chain stress, used cars, clothing costs are all falling combined with major base effects suggesting a meaningful fall in inflation over the next 12-18 months, which will support real disposable incomes boosting global growth.

- Interest rates peak and decline in the second half of the year. Interest rate cycles were in full swing in 2022 and the major Central Banks delivered a cumulative 27% increase in interest rates. The US Federal Reserve moved from near 0% to 4.5%, similarly the UK Bank of England (BoE) moved from 0% to 3.5%. It is rare to see such a dramatic shift in interest rates in terms of size and pace, and it is very unlikely to be repeated. We expect interest rate cuts to be the more dominant course of action from here for Central Banks over 2023 as growth and inflation weaken, which will ease global financial conditions supporting asset prices and economic growth.

- Chinese reopening boosts global growth. China’s move away from its Zero Covid Policy has been swift and dramatic, with many estimates suggesting between 50-90% of the population in the major cities have now been infected in a matter of weeks. As seen in the West, once an economy reopens, consumption and growth rebounds sharply and households draw down on excess savings. There is c.US$1.5 trillion (c.10trn RMB) in excess savings and consumer debt for Chinese households to spend once reopening is complete. Simply reopening your economy is the most powerful stimulus a Government can provide and as the second largest economy in the world this is very supportive of global growth.

- European Energy Crisis subsides. The European Energy Crisis is not just an inflation problem, but also a market sentiment problem, a European growth problem, as well as a European unity problem – it is much more than just inflation for the markets. However the mild winter weather, combined with high storage levels and good preparation has brought the EU gas price to c.€60 down from a peak of c.€340 in August. It is now lower than pre-invasion in February 2022, an incredible development considering the Russia-Ukraine War is still ongoing and the Nord Stream 1 gas pipeline is still shut. European gas prices averaged c.€130 over 2022, so at c.€60 today suggests annual energy inflation for the European consumer will fall dramatically over 2023 and

beyond. Critically, a collapsing gas price greatly reduces the leverage Putin has over the West, combined with successful Ukrainian counteroffensives on the ground should increase the likelihood of a ceasefire or settlement in 2023, another positive catalyst for markets. - Underlying Leading Economic Indicators (LEIs) start to improve. Recent economic data from Developed Market (DM) economies has been weak with measures of economic activity such as the Purchasing Manager Indices (PMIs) firmly in contraction and below 50.0 mark. The Global Manufacturing PMI fell to a 30-month low of 48.6 in December and remained below 50.0 for the fourth straight month. So, we are currently in a global contraction. However, a mild and brief recession is still the most probable outcome. If we look further out at the Leading Economic Indicators (LEIs) particularly across Emerging Markets, Latin America, China and Japan we can see improvement is visible, and should dovetail with the slowing DM economies in first half of the year, before we see a recovery in DM countries in the second half of the year.

Markets Set To Improve in 2023

Equity markets have discounted a meaningful amount of uncertainty and economic gloom, highlighted by falling valuations. UK, European, Japanese and Emerging Market equities are trading between 11x and 13x forward Price to Earnings (PE) valuation multiples, down from a peak of 15x to 18x, and below their long-term average valuations.

Given the rise in bond yields and corporate bond spreads, the income on offer from bonds is now far more appealing. Only 2 years ago, there was $1.8 trillion ”worth” of negatively yielding bonds globally, i.e. counter intuitively and against all economic sense you had to pay to lend to certain governments, however at the start of 2023 the level of negative yielding debt is now zero, highlighting the increasing value in global Fixed Interest markets.

Long-term return prospects have improved meaningfully, as one would expect after a year of sharply negative returns for asset classes and a meaningful rise in the risk free rate. A rising risk free rate (cash rates) increases the potential future return for risky asset classes across the risk curve.

Investor sentiment indicators are at depressed levels and fund managers have raised cash levels suggesting much of the selling and repositioning has occurred over 2022. From these levels of negativity, the probabilities of a positive shift in sentiment are very high, and when investors turn increasingly more bullish, or less bearish, the return from markets has historically been powerful.

Probabilities, history and valuations are on our side in 2023. If we look at decades of market data, the probability of a better return year for markets is very high after such as terrible prior year for returns. And 2022 was one of the worst years for bond and equity markets ever, however the pain was mostly felt in the first half of last year with market performance improving in the second half despite the difficult backdrop. This suggests most of the poor economic, corporate and geopolitical news was priced in the first half, and markets have started to look ahead to brighter days in 2023 and beyond. If the recession is mild as we expect, any further market declines will be limited and short lived.

Top-3 Risks To Outlook

- Housing Market Risk – the current risk to the housing market is a culmination of prior risks and crisis’, including rising inflation, interest rates and bond yields, resulting in a more than doubling in mortgage rates in US, UK and Europe, as well as the pandemic leading to excessive demand for houses over flats and a shift from city to suburbia resulting in a massive surge in house prices. So, current housing affordability is dire. However, supply of new housing is very low, mortgage rates are gradually coming down from a high level, and credit worthiness of homeowners and new buyers is far superior relative to prior periods of housing market stress say in 2008/09. The foundations are more robust, but the housing market is cyclical and is very sensitive to interest rates, and house price growth has been abnormally high in recent years, so there is a risk that house prices in US, UK and certain European countries fall sharply this year, impacting the consumer.

- Recession Risk – the recession is now well anticipated and has been discussed at length by the talking heads on Bloomberg and CNBC, however the risk is that the recession is more severe than expected and this will be driven by the actions of Central Banks and critically the jobs market. Currently, the jobs market remains healthy but is weakening with the level of vacancies and quit rates falling and wider measures of employment softening more rapidly. So, what the job market looks like in 3-6 months’ time, as well as the housing market, will have significant impact on the timing and power of the recovery from the recession. A more severe recession is not currently priced into markets.

- Geopolitical Risk – any escalation of the Russia-Ukraine War is an obvious risk to stability, growth and inflation. However the avenues for escalation from here are narrow, and many of the avenues touted such as Putin invading another European country and/ or using nuclear weapons are very low probability events. The conflict is currently contained in the Eastern provinces. Ukrainian counteroffensives are progressing well and a collapsing European gas price greatly reduces the leverage Putin has over the West, and should increase the likelihood of ceasefire or settlement. Biden and Macron have repeatedly talked about off-ramps i.e., giving Putin an out or small win to end the war and remove threat of nuclear warfare or a re-escalation that forces the US and EU to engage more meaningfully which they do not want.

To discuss your investment strategy please contact your Chase de Vere financial adviser. Alternatively, if you’ve not dealt with us before, you can request to speak to one of our advisers.

Important information

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Information was obtained from proprietary and non-proprietary sources deemed reliable by Chase de Vere.

Where the qualified Investment Manager has expressed views and opinions, they are based on current market conditions and their professional judgement and are subject to change.

The information contained within this update is for guidance only and does not constitute advice which should be sought before taking any action or inaction.

Prices were correct at the time of writing.